Holy fuck….

In the article:

The top 45p income tax rate on earnings of more than £150,000 a year will be scrapped, leaving the highest rate at 40p.

Just for comparison:

in NL the rate is 37.09% up to EUR 69,399 and 49.5% for anything beyond EUR 69,399…

Oh, the first EUR 2.250 will not be taxed. Yay.

Think the average salary in the UK is £26k compared to £31k in NL though.

They need a higher salary, have you seen their tax rates😁

Yeah, but they actually get something for their tax dollars, unlike here where it’s siphoned off into Tory donors’ pockets.

As I’ve said before, the Tory party now is basically a crime family - they exist to get elected and steal tax payer’s money to enrich themselves and their backers.

I know, this is why comparing tax rates and average salaries between countries is pointless unless you also throw in benefits and a host of other factors.

The strange thing is, I find the UK expensive compared to NL or D.

And interesting to see the max tax rate in NL at roughly 2x the average income, whereas in the UK the max rate is at 6x the average.

It would be interesting to compare the total tax take on a range of purchases. We may ‘only’ pay 40p/£ income tax, but then there is NI on top, then if we use that money to buy petrol, a huge chunk of that is tax (albeit in different forms), similarly the 20% VAT on most routine purchases, tax on any (many mandatory) insurances, etc etc

Like in NL 100% of adults (18 and over) have a health insurance with a commercial health insurance company at a cost of at least EUR 110 or higher per month…

Also wider structural issues. Countries that export natural resources perhaps don’t need to attract foreign investment for manufacturing and hence don’t have to be concerned about increased costs for businesses etc.

Unfortunately I can’t compare my insurance costs as NI covers a lot of other services outside health. Would probably need to look at funding per head of health services, but even then you would have to factor in outcomes, coarsely fine with average life expectancy.

Now that takes skill to achieve.

The comparison with NL is meaningless for all sorts of reasons.

Apologies, I see Bob has just made the same point.

The broader point (I think) you are trying to make is correct, but you’re not using the right data to support it.

This is a more detailed examination that reaches even more concerning conclusions FT article

WeFail on-point today -

I just heard some talking head on Politics Live claim that it now costs the UK government more to borrow than it costs the governments of Italy and Greece.

In the last 12 years we’ve had the catastrophe of austerity, or the good old days as they are now referred to, the unmitigated ongoing act of self-harm that is Brexit and now we have a bunch of far right idealogues that are pissing the reputation of the country for sound money right up the wall.

And yet, come the next election, whoever the Tory PM is only needs to warn of a coalition of chaos between the SNP and Labour and all the English nationalists and xenophobes will vote them in again. Wank.

The point I wanted to make is that the UK max tax rate

- kicks in at only insanely high incomes

- is still lower than the NL rate before the cut

- and is being cut from 45% to 40%

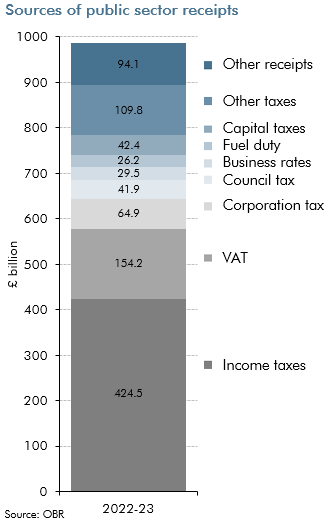

In that context, I wonder how UK Gov wants to finance public services, as income tax is the biggest part of the income:

And again, my point is: So what?

It means nothing taken in isolation, as you are doing.

A short list of other factors you’ve ignored.

- Other direct taxation

- Indirect tax rates

- Currency valuation

- Level of imports

- Level of exports

- Comparison of public service provision

- Relative cost of goods and services